How I Built a Smarter Portfolio for Steady Growth—No Luck Needed

What if growing wealth wasn’t about chasing hot stocks or timing the market? I learned the hard way that volatility kills long-term progress. After years of ups and downs, I shifted to a systematic approach focused on return stability. It’s not flashy, but it works. This is how I redesigned my asset allocation to grow wealth steadily—without losing sleep over market swings. The journey wasn’t about finding a magic formula or predicting the next big trend. It was about understanding that true financial progress comes not from how high you climb, but how well you stay on the path when conditions change. Over time, I discovered that consistency, discipline, and structure matter far more than momentary wins. This story isn’t about overnight success—it’s about building a resilient financial foundation that grows quietly, reliably, and sustainably.

The Wake-Up Call: Why Chasing Returns Backfired

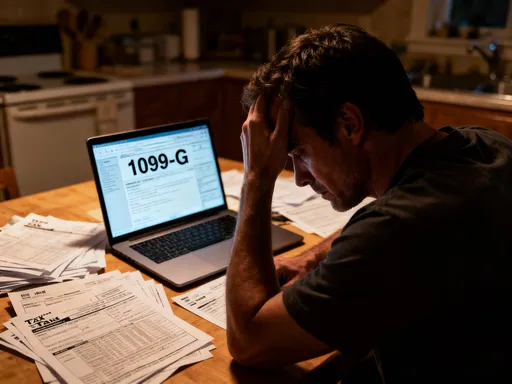

For years, I believed that successful investing meant chasing the highest possible returns. I watched financial news closely, scanned headlines for the next breakout stock, and moved money quickly when a fund started gaining attention. My strategy was simple: find what was working and get in fast. At first, this approach seemed to pay off. There were quarters when my portfolio surged ahead, outpacing friends and family who took a more cautious route. But those gains came with a hidden cost—one I didn’t recognize until a sharp market correction hit. In just six weeks, nearly all of my progress from the previous year evaporated. What felt like growth turned out to be temporary, built on momentum rather than durability.

That experience was a turning point. I began to question whether chasing performance was actually helping me build lasting wealth—or simply exposing me to greater risk. I studied historical data and realized something surprising: portfolios with moderate but steady returns often outperformed those with dramatic spikes and drops over ten-year periods. The reason? Volatility erodes compounding. When a portfolio falls 30%, it needs to gain more than 40% just to break even. Those recovery periods delay growth and increase emotional stress, making it harder to stay the course. I saw that protecting capital during downturns was just as important as capturing gains during upswings.

More than the financial loss, the emotional toll was significant. I found myself checking my account daily, reacting to small movements, and feeling anxious whenever markets dipped. Investing had become a source of stress rather than progress. I realized I needed a new approach—one that didn’t rely on timing the market or guessing which asset would lead next. Instead of focusing on how much I could earn in good years, I started asking how much I could preserve in difficult ones. This shift in mindset marked the beginning of a more disciplined, thoughtful strategy grounded in long-term stability rather than short-term excitement.

What Systematic Asset Allocation Really Means (And Why It’s Different)

When I first heard the term systematic asset allocation, I assumed it was just another way of saying “diversified portfolio.” But I soon learned it’s much more than that. Systematic allocation isn’t about making occasional adjustments based on gut feelings or market trends. It’s about establishing clear, repeatable rules for how money is invested and managed over time. Think of it like driving with cruise control and lane assist instead of white-knuckling the wheel through every turn. The system operates based on predefined criteria, removing emotion and impulse from the decision-making process.

Traditional investing often follows a reactive pattern: buy when prices rise, sell when they fall, shift focus when a new opportunity emerges. This approach may feel proactive, but it’s vulnerable to behavioral biases—fear, greed, overconfidence—that lead to poor timing and inconsistent results. In contrast, a systematic method follows a consistent framework regardless of market noise. For example, instead of asking, “Should I move money into tech stocks because they’re hot?” I ask, “Does my current allocation align with my long-term plan?” If not, I follow a rule-based process to correct it, not a hunch.

One of the most powerful aspects of this method is its ability to enforce discipline. Markets naturally encourage us to do the wrong thing at the wrong time—panic selling after a drop, overinvesting after a rally. A systematic approach counters this by treating the portfolio like a machine with inputs, processes, and outputs. The inputs are contributions from income or savings. The process includes rules for allocation, diversification, and rebalancing. The output is a steady, predictable growth trajectory. Over time, this consistency leads to better outcomes, not because of superior insight, but because of reduced error and emotional interference.

Another key difference is sustainability. While active trading demands constant attention and decision-making, a systematic strategy can run reliably with minimal intervention. This is especially valuable for individuals who want to build wealth without turning investing into a second job. By automating core decisions—such as when and how to rebalance—I freed up mental energy and reduced the temptation to interfere. The result was not just better performance, but greater peace of mind.

Building the Foundation: The Three Pillars of Stability

After abandoning the chase for high returns, I set out to rebuild my portfolio around three core principles: balance, rebalancing, and behavior control. These became the pillars of my new strategy, each reinforcing the others to create a stable financial structure. Balance means avoiding overexposure to any single asset class, even if it’s performing well. It’s tempting to pour more money into a winning investment, but history shows that what leads one year often lags the next. By maintaining a balanced mix of assets—such as stocks, bonds, and alternative holdings—I reduced the risk of being overly dependent on any one market segment.

Rebalancing is the engine that keeps balance intact. Without it, a portfolio naturally drifts as some assets grow faster than others. For instance, if stock markets rise sharply, equities might grow from 60% of a portfolio to 75% in just a few months. That increases risk, even if the investor never intended to take on more. My solution was to establish a fixed rebalancing schedule—reviewing allocations every quarter and making adjustments when any asset class moved beyond a set range, such as plus or minus 5 percentage points. This meant automatically selling portions of assets that had appreciated and buying more of those that had declined, effectively enforcing the principle of buying low and selling high.

Behavior control was the most challenging pillar to implement, yet the most impactful. I realized that no strategy works if the investor undermines it through emotional decisions. To protect against this, I designed my system to minimize the need for judgment calls. Rules replaced reactions. I stopped monitoring daily price movements and limited portfolio reviews to scheduled check-ins. I also removed access to my investment accounts from my phone, reducing the temptation to react to short-term fluctuations. Over time, this detachment helped me stay focused on long-term goals rather than momentary swings.

Together, these three pillars created a self-correcting system. Balance ensured diversification stayed meaningful. Rebalancing maintained risk levels. Behavior control preserved discipline. I didn’t need to predict the future—only follow the plan. And because the system was rule-based, it worked whether markets were rising, falling, or flat. This foundation didn’t promise explosive growth, but it delivered something more valuable: reliability.

How Diversification Actually Reduces Risk (Not Just Spreads It)

Most people think of diversification as simply owning a variety of investments. “Don’t put all your eggs in one basket,” they say—and then proceed to fill multiple baskets with eggs that behave the same way. True diversification isn’t about quantity; it’s about correlation. Two assets are highly correlated if they move in the same direction at the same time. If all the holdings in a portfolio rise and fall together, a market downturn still causes significant damage, no matter how many funds are involved.

I learned this the hard way during a period of rising interest rates. At the time, I held several bond funds and dividend-paying stocks, assuming they were conservative choices. But when rates increased, both asset classes declined simultaneously because they were sensitive to the same economic factor. My portfolio dropped more than expected, despite being “diversified.” That experience led me to study how different assets respond to various economic conditions—growth, inflation, recession, deflation—and to build a portfolio where components reacted differently under stress.

For example, during inflationary periods, commodities and real estate tend to hold value better than fixed-income investments. In contrast, bonds often perform well when growth slows and interest rates fall, while stocks may struggle. By including assets with low or negative correlations, I reduced the likelihood that everything would decline at once. This doesn’t eliminate risk, but it spreads it across different drivers, making the portfolio more resilient. I began mapping my holdings to potential economic scenarios, asking not just “Will this grow?” but “How will this behave if the economy slows?” or “What happens if inflation rises?”

This strategic approach to diversification transformed my portfolio from a collection of individual investments into an integrated system. Instead of chasing returns within each category, I focused on how the pieces worked together. The goal wasn’t to maximize gains in any single environment, but to ensure the portfolio could withstand a range of outcomes. Over time, this led to smoother performance, fewer extreme swings, and greater confidence in staying invested through market cycles.

The Rebalancing Rhythm: Why Timing the Market Is Overrated

For a long time, I believed that successful investing required being in the right place at the right time. I watched market indicators, followed economic forecasts, and tried to anticipate turns in the cycle. But my attempts at timing the market rarely worked. More often than not, I bought after prices had already risen and sold after they had fallen. The emotional toll was exhausting, and the results were underwhelming. It wasn’t until I adopted a regular rebalancing rhythm that I finally broke free from the cycle of poor timing.

I started with a simple rule: review my portfolio every three months and make adjustments only if any asset class had drifted beyond its target range. At first, this felt unnatural. There were times when rebalancing meant selling an asset that had been performing well—just as it seemed poised to go higher. Other times, it required buying into a sector that had recently declined, which felt risky. But I stuck with the process, trusting the data over my instincts. Over time, I saw that this mechanical approach consistently bought low and sold high, not through prediction, but through discipline.

The psychological benefits were just as important as the financial ones. Knowing I had a plan reduced anxiety. I no longer felt pressured to interpret every news headline or react to weekly market movements. Rebalancing became a routine, like changing the oil in a car—boring but essential. It kept the portfolio running smoothly and prevented small imbalances from turning into major risks.

Research supports this approach. Studies have shown that investors who rebalance regularly tend to achieve more stable returns over time, even if they miss out on short-term rallies. The reason is simple: they avoid the compounding damage of holding too much risk when markets peak and too little when they recover. By maintaining a consistent risk profile, rebalancing helps preserve capital and supports long-term growth. For me, it became the single most effective habit in my investing routine—one that required little effort but delivered lasting results.

Real-World Trade-Offs: What Stability Costs (And What It Saves)

There’s no such thing as a risk-free investment, and a stability-focused strategy comes with its own trade-offs. The most noticeable is opportunity cost. While I was maintaining balance and rebalancing, there were periods when other investors made much higher returns by concentrating in hot sectors—technology, crypto, or emerging markets. Seeing those numbers was frustrating. I had to accept that my portfolio wouldn’t lead the rankings every year. But I also avoided the deep losses that followed when those same sectors collapsed. Over a decade, the difference in outcomes was clear: my portfolio grew at a moderate but steady pace, while others experienced dramatic swings that took years to recover from.

One way to understand this is through the math of compounding. A portfolio that loses 50% needs a 100% gain just to return to its starting point. A more stable portfolio that avoids such drops can compound gains more effectively, even if its annual returns are lower. For example, a portfolio earning 6% annually with minimal volatility will outperform one that averages 8% but suffers frequent 20%+ drawdowns. The reason is that large losses interrupt compounding and require much higher returns to overcome. By prioritizing stability, I preserved capital and allowed compounding to work uninterrupted.

Another benefit was sustainability. High-volatility strategies often require constant monitoring, frequent trading, and strong nerves. Many investors eventually abandon them during downturns, locking in losses. My systematic approach, in contrast, was designed to be maintainable over decades. It didn’t depend on perfect decisions or ideal market conditions. It worked best when left alone. This consistency reduced stress and increased the likelihood that I would stay the course, which is one of the strongest predictors of long-term success.

In the end, the strategy didn’t make me rich overnight. But it helped me build wealth that I could count on—a foundation that supported my family, funded goals, and provided peace of mind. That, to me, was worth far more than chasing the highest possible return.

Making It Work for You: Simple Steps to Start Today

You don’t need a large account balance, a finance degree, or a private wealth manager to adopt a systematic approach. The principles are accessible to anyone willing to commit to consistency over spectacle. The first step is to audit your current portfolio. List all your holdings and calculate the percentage each represents. Are you overly concentrated in one asset class or sector? Does your allocation reflect your long-term goals, or has it drifted based on performance?

Next, define your target allocation. This should be based on your time horizon, risk tolerance, and financial objectives. A common starting point is a mix of stocks and bonds, adjusted for age and goals—for example, a moderate portfolio might aim for 60% equities and 40% fixed income. Once you’ve set your targets, establish allocation bands—such as allowing each asset class to vary by plus or minus 5 percentage points before triggering a rebalance. This prevents excessive trading while maintaining discipline.

Choose a rebalancing frequency that fits your lifestyle. Quarterly or semi-annual reviews are common and effective. Use calendar reminders to stay consistent. When rebalancing, sell from overweight positions and buy underweight ones, following your rules without emotional influence. Over time, this process will become routine and require less effort.

Finally, track progress without obsession. Review performance annually to ensure the strategy is working, but avoid checking daily or weekly. Focus on trends, not noise. Remember, the goal isn’t perfection—it’s progress. Small, consistent actions compound just like investment returns. By building a system that runs on rules rather than reactions, you create a sustainable path to wealth that doesn’t depend on luck, timing, or constant attention. It’s not exciting, but it’s reliable. And in the long run, reliability wins.

Looking back, the smartest move I made wasn’t picking the right stock—it was stepping back and designing a system that works whether I’m watching or not. Wealth appreciation isn’t just about returns; it’s about keeping what you earn. By focusing on return stability through systematic asset allocation, I turned investing from a rollercoaster into a steady climb. And that, more than any single gain, changed everything.