How I Survived My Worst Investment Loss—And What Fixed My Portfolio

Losing money in the market feels like a gut punch. I’ve been there—watching my portfolio shrink, questioning every decision. But that crash became my turning point. Instead of chasing returns, I rebuilt with a smarter strategy: intentional asset allocation. It’s not about timing the market; it’s about structuring your money to survive—and thrive—through ups and downs. Here’s how I did it, and how you can too.

The Crash That Changed Everything

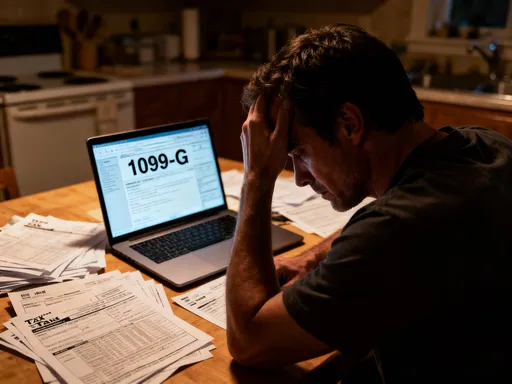

It started with confidence—maybe too much. I had read articles about fast-growing tech stocks, listened to podcasts where investors boasted double-digit returns, and convinced myself I could pick winners just like them. At the peak, nearly 80 percent of my portfolio was concentrated in growth equities, mostly in a handful of sectors I believed were the future. I told myself diversification wasn’t necessary because these companies were leaders in innovation. I was wrong.

When the market turned, it didn’t creep down—it plunged. Over six months, my portfolio lost nearly 45 percent of its value. I remember logging in one Tuesday morning and seeing the numbers in red, feeling my stomach drop. It wasn’t just the money; it was the realization that I had ignored basic principles in pursuit of quick gains. I had mistaken confidence for competence, and momentum for safety. Every article I clicked on seemed to confirm my fears: more corrections, regulatory scrutiny, rising interest rates. The more I watched, the more anxious I became.

What made it worse was my reaction. In a moment of panic, I sold a portion of my holdings at the lowest point, locking in losses I might have recovered. Then, when the market began to stabilize, I hesitated—too scared to reinvest, too proud to admit I needed help. That period taught me a hard truth: emotional decisions compound financial losses. The real problem wasn’t the market crash; it was the lack of structure in my investment approach. I had no plan to fall back on, no guardrails to prevent overexposure or guide my response. That experience didn’t just cost me money—it cost me peace of mind.

But in hindsight, it was the best thing that could have happened. Losing money forced me to confront my assumptions. I stopped chasing performance and started studying strategy. I read books by respected financial planners, attended webinars on portfolio design, and spoke with a fee-only advisor who didn’t profit from my trades. What I discovered reshaped my entire outlook: sustainable wealth isn’t built through stock picking or market timing. It’s built through disciplined asset allocation—the intentional distribution of investments across different categories to manage risk and support long-term growth.

Why Asset Allocation Is Your Financial Backbone

Asset allocation is often described in technical terms, but at its core, it’s about balance. Think of your financial life as a house. You wouldn’t build it on sand, hoping it won’t shift when the wind blows. You’d lay a strong foundation, anchor it deep, and design it to withstand storms. Asset allocation is that foundation. It’s the framework that holds your investments together when markets become unpredictable.

Unlike stock picking, which focuses on individual performance, asset allocation looks at the bigger picture: how different types of investments interact with one another. These categories—commonly stocks, bonds, real estate, and cash equivalents—respond differently to economic conditions. When stocks fall during a downturn, high-quality bonds often hold steady or even rise. When inflation climbs, real assets like property or commodities may preserve value. By spreading money across these areas, you reduce the impact of any single failure.

Studies have consistently shown that asset allocation is the primary driver of long-term investment returns. A landmark analysis by Brinson, Hood, and Beebower found that over 90 percent of a portfolio’s variability in returns comes from its asset mix, not individual security selection or market timing. That doesn’t mean stock choices don’t matter—but they matter far less than the overall structure. A well-allocated portfolio with average investments will typically outperform a poorly structured one with stellar picks over time.

For me, this was a revelation. I had spent hours researching earnings reports and CEO interviews, believing that knowledge would protect me. But no amount of insight into a single company can shield you from systemic risk—the kind that affects entire markets. Asset allocation doesn’t eliminate risk, but it manages it in a predictable, measurable way. It replaces guesswork with intention. Instead of asking, “Which stock will go up next?” I began asking, “What mix of assets aligns with my goals, timeline, and tolerance for volatility?” That shift in thinking marked the beginning of a more mature, resilient approach to investing.

The Difference Between Diversification and Real Protection

Before my losses, I thought I was diversified. After all, I owned ten different stocks across tech, healthcare, and consumer goods. I checked my portfolio weekly, proud of the variety. But when the market dropped, all ten declined—some by more than 50 percent. That’s when I realized I had confused diversification with mere variety. True diversification isn’t about how many stocks you own; it’s about how differently your assets behave under stress.

Real protection comes from holding assets that are not highly correlated—meaning they don’t move in lockstep. For example, when stock markets fall due to economic uncertainty, government bonds often gain value because investors seek safety. Real estate may hold its ground due to rental income, even if prices stagnate. Cash and short-term Treasury securities provide liquidity and stability, allowing you to avoid selling depressed assets during downturns. These asset classes respond to different forces: interest rates, inflation, employment data, and global events. By combining them, you create a portfolio that doesn’t rely on a single economic outcome.

My previous strategy failed because all my holdings were equities—exposed to the same risks. When investor sentiment shifted, there was nowhere to hide. True diversification would have included non-equity assets that act as shock absorbers. For instance, during the 2008 financial crisis, while U.S. stocks fell nearly 38 percent, long-term government bonds returned over 20 percent. A balanced portfolio wouldn’t have avoided losses, but it would have significantly reduced them.

Another common misconception is that international stocks automatically provide diversification. While global exposure can help, many foreign markets are increasingly tied to U.S. trends, especially in technology and finance. Geographic diversification adds value, but it’s not a substitute for asset class diversification. The key is to build layers of protection: different sectors, different countries, and—most importantly—different types of investments that serve distinct roles. Stocks aim for growth, bonds provide income and stability, real estate offers inflation protection, and cash ensures flexibility. Together, they form a system designed to endure, not just perform in good times.

Building a Resilient Allocation Strategy

Rebuilding my portfolio wasn’t about picking the next big winner. It was about designing a system that could handle uncertainty. I started by defining my goals: retirement in 20 years, funding my children’s education, and maintaining an emergency fund. Each goal had a different time horizon, which influenced how much risk I could afford to take.

I assessed my risk tolerance honestly—not how I wanted to feel, but how I actually reacted when markets fell. I used questionnaires from reputable financial planning sites and reflected on past behavior. I realized I was a moderate investor: willing to accept some volatility for growth, but unable to sleep through extreme swings. That self-awareness guided my asset mix. For long-term goals, I allocated a majority to equities, but spread across U.S. large-cap, small-cap, and international funds through low-cost index funds. For stability, I dedicated a significant portion to intermediate-term bond funds and Treasury Inflation-Protected Securities (TIPS).

My new allocation followed a simple but deliberate structure: 60 percent stocks, 30 percent bonds, 5 percent real estate investment trusts (REITs), and 5 percent cash or cash equivalents. This wasn’t a magic formula—it was a starting point based on my age, goals, and emotional capacity. Younger investors might tolerate more stock exposure; those nearing retirement might lean heavier on bonds. The important part was intentionality. Every percentage had a purpose.

I also committed to avoiding overconcentration. No single stock would exceed 5 percent of my portfolio, and no sector would dominate. This meant selling some holdings I was emotionally attached to but that no longer fit the plan. I automated contributions to ensure consistency, directing new money into underweight areas to maintain balance. Most importantly, I introduced rebalancing—a scheduled review every six months to realign my portfolio to its target mix. If stocks surged and grew to 70 percent of my holdings, I would sell a portion and reinvest in bonds to return to 60/30. This forced me to “sell high and buy low” systematically, removing emotion from the process.

When to Stick With It—and When to Adjust

One of the hardest lessons in investing is knowing when to stay the course and when to adapt. Markets will fluctuate—sometimes dramatically. Reacting to every dip or rally leads to whipsaw losses and missed recoveries. But life also changes: job transitions, health issues, family needs, or shifts in financial goals. These moments may require thoughtful adjustments to your allocation.

After my crash, I made a rule: no changes during market turmoil. I would only review my strategy during calm periods, at least six months after any major downturn. This prevented panic-driven decisions. I also defined clear triggers for reallocation: a change in income, a major purchase, or a shift in long-term objectives. For example, when I decided to semi-retire early, I revised my withdrawal plan and gradually reduced equity exposure to preserve capital.

Sticking with a plan doesn’t mean ignoring reality. Inflation, interest rate trends, and economic cycles do matter. But adjustments should be measured, not reactive. I no longer try to predict where the market is headed. Instead, I ask whether my current allocation still serves my goals. If yes, I stay the course. If not, I make incremental changes—no more than 5 to 10 percentage points at a time—after careful analysis.

This balance between discipline and flexibility has been crucial. It allows me to benefit from long-term compounding while remaining responsive to life’s unpredictability. I’ve learned that consistency beats cleverness in investing. The most successful investors aren’t those who time the market; they’re the ones who stick to a sound strategy through all conditions, adjusting only when fundamentals—not emotions—demand it.

Tools and Habits That Keep You on Track

A great plan means nothing without execution. After rebuilding my portfolio, I focused on creating systems that supported discipline. I started using a portfolio tracker—free tools like those offered by major brokerage firms or independent financial websites—that showed my asset mix in real time. With a glance, I could see if I was drifting from my targets.

I set calendar reminders for quarterly check-ins and semi-annual rebalancing. These weren’t opportunities to trade impulsively, but structured moments to review performance, contributions, and allocation. I also automated as much as possible: monthly contributions to retirement accounts, dividend reinvestments, and transfers to my emergency fund. Automation removed the need for constant decision-making, reducing the chance of emotional interference.

Perhaps the most powerful change was internal. I worked on shifting my mindset. Instead of checking my account daily, I limited reviews to once a month. I stopped comparing my returns to headlines or neighbors’ stories. I began measuring success not by short-term gains, but by adherence to my plan. Did I rebalance on schedule? Did I avoid panic selling? Did I save consistently? These became my new metrics.

I also educated myself continuously—but selectively. I read books by trusted authors like Vanguard founder John Bogle and financial planner Jane Bryant Quinn. I followed regulators like the Securities and Exchange Commission for investor alerts and warnings. I avoided get-rich-quick content and social media hype. Over time, this habit built confidence. I no longer felt the need to “do something” when markets moved. I understood that volatility is normal, not a signal to act. In fact, the most productive thing I could do was often nothing at all—except stay the course.

Turning Losses Into Long-Term Gains

Today, my portfolio is not the highest-performing I’ve seen. Some years, it lags behind market indexes. But over time, it has grown steadily, recovered fully from past losses, and continues to support my family’s financial well-being. More importantly, I sleep better at night. I no longer fear the next downturn because I know my strategy is designed for it.

What felt like a financial disaster became the catalyst for lasting change. That loss taught me humility, discipline, and the value of structure over speculation. I no longer chase returns; I build resilience. I don’t try to outsmart the market; I prepare for its unpredictability. Asset allocation didn’t just fix my portfolio—it transformed my relationship with money.

The truth is, everyone will face investment losses. Markets go down. Companies fail. Economies shift. But a well-structured portfolio turns those events from catastrophes into manageable setbacks. It provides clarity when emotions run high and stability when uncertainty looms. It’s not a guarantee of profits, but a commitment to process.

If you’ve experienced a loss, know this: it doesn’t define your financial future. What matters is what you do next. You can rebuild—not by searching for the next hot stock, but by laying a stronger foundation. Start with honest self-assessment. Define your goals. Choose an allocation that reflects your reality, not your hopes. Put systems in place to stay consistent. And remember, the goal isn’t to avoid all risk—risk is necessary for growth—but to manage it wisely.

Investing is a marathon, not a sprint. The most powerful tool you have isn’t a secret strategy or insider knowledge. It’s a disciplined, balanced approach that endures through time. My worst loss became my best teacher. And if you let it, yours can too.