What I Learned About Taxes When Unemployment Hit — The Pitfalls Nobody Warns You About

Losing my job last year didn’t just mean no paycheck — it threw my entire financial plan into chaos. I quickly realized that tax planning wasn’t just for the wealthy or employed. In fact, doing it wrong during unemployment could cost me hundreds, maybe thousands. I made mistakes — claiming benefits incorrectly, missing credits, underestimating liabilities. Now I’m sharing what I learned the hard way, so you don’t have to fall into the same traps. What started as a period of uncertainty became a crash course in personal finance, especially around taxes — an area most of us ignore until it’s too late. This is not just about surviving job loss, but about protecting what little stability remains.

The Shock of Job Loss: When Income Stops but Taxes Don’t

When the layoff notice came, my first concern was how to cover rent, groceries, and car payments. Taxes were the last thing on my mind. Like many, I assumed that without a paycheck, my tax obligations would pause too. But the reality hit quickly: even when income stops, tax responsibilities often don’t. The severance package I received was taxed at a higher rate than my regular salary. Worse, I didn’t realize that unemployment benefits — the very lifeline I depended on — were also considered taxable income by the federal government. This misunderstanding created a dangerous illusion of financial breathing room. I spent those early months believing I had more disposable income than I actually did, only to face a growing tax liability I hadn’t budgeted for.

The emotional toll of job loss clouds financial judgment. Stress, anxiety, and the pressure to maintain normalcy make it easy to overlook long-term consequences. I remember sitting at my kitchen table, reviewing my first unemployment check, relieved to see the full amount deposited. What I didn’t see was the invisible tax debt accumulating beneath the surface. The IRS treats unemployment compensation as part of your gross income, just like wages. That means it’s subject to federal income tax, and in most states, state income tax as well. Failing to account for this can lead to a significant tax bill come April — a burden few unemployed individuals are prepared to handle. The shock isn’t just financial; it’s psychological. After months of cutting back and surviving on less, receiving a surprise tax demand can feel like a second layoff.

What made this worse was the lack of clear communication. Nowhere on the initial application for unemployment did it explicitly state that these benefits were taxable. It wasn’t until I dug into IRS publications months later that I found the truth buried in fine print. This absence of upfront disclosure is a systemic flaw that leaves vulnerable people exposed. You don’t need a tax degree to understand your obligations, but you shouldn’t have to become an amateur accountant just to survive a job loss. The lesson here is simple: any income, regardless of source, must be evaluated for tax implications. Assumptions are expensive, especially when made under stress. Recognizing that taxes don’t take a break when your job does is the first step toward regaining control.

The Hidden Tax Traps in Unemployment Benefits

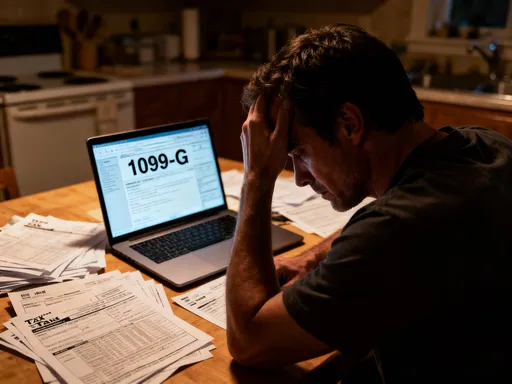

One of the most misleading aspects of unemployment compensation is how it’s delivered. Each week, a direct deposit lands in your account — clean, predictable, and seemingly straightforward. But behind the scenes, the tax treatment varies significantly depending on where you live. The federal government taxes unemployment benefits in full, but individual states differ widely in their approach. Some states, like California and New Jersey, automatically withhold a portion of your benefits for state income tax. Others, like Florida and Texas, have no state income tax at all, meaning nothing is withheld. Then there are states like Pennsylvania, where unemployment is taxable but no withholding occurs unless you request it. This patchwork system creates confusion and increases the risk of underpayment.

I learned this the hard way. Living in a state with no automatic withholding, I received my full benefit amount each week. It felt like a small victory — until I realized I was on the hook for the entire tax liability when filing. Unlike salaried employees who have taxes deducted incrementally, recipients of unemployment income must either pay estimated taxes quarterly or face a large lump sum later. Because I didn’t set aside money each month, I ended up owing over $1,200 in federal taxes alone — a sum I couldn’t afford. The IRS does allow you to opt into voluntary federal tax withholding when you apply for benefits, typically at a rate of 10%. This simple choice, which I ignored, could have prevented much of the stress.

The inconsistency across states adds another layer of complexity. If you move during unemployment — perhaps to reduce living costs or be closer to family — you may trigger multi-state tax filings. For example, if you earned unemployment benefits in one state but now reside in another, you might need to file returns in both jurisdictions. This not only increases paperwork but also the potential for errors. Additionally, the 1099-G form, which reports your total unemployment income, often arrives late — sometimes weeks after tax season begins. If you’re waiting on this form to file, you may miss deadlines or rush your return, increasing the chance of mistakes. The takeaway is clear: don’t treat unemployment income as disposable. Treat it as taxable income from day one. Opt into withholding if possible, track your payments carefully, and consult a tax professional if your situation involves multiple states or overlapping benefits.

Early Withdrawals: A Quick Fix with Long-Term Consequences

After three months without steady income, my emergency fund was nearly gone. My credit cards were maxed out, and I faced a difficult decision: dip into my retirement savings or risk falling behind on essential bills. It seemed like a no-brainer at the time. I had worked hard for that money, and now I needed it. What I didn’t fully understand was the true cost of an early withdrawal. Withdrawing from a traditional IRA or 401(k) before age 59½ triggers two financial penalties: ordinary income tax on the amount withdrawn, plus a 10% early withdrawal penalty imposed by the IRS. Depending on your tax bracket, this can mean losing up to 30% or more of the withdrawn amount right off the top.

I considered pulling $15,000 from my 401(k). At my marginal tax rate of 22%, that would have generated about $3,300 in federal taxes. Add the 10% penalty — $1,500 — and the government would have taken nearly $4,800. That’s over 30% of my emergency fund, gone before I even spent a dollar. And that’s not including potential state taxes, which in some states could add another 5-10%. The money I thought was mine to use came with a steep price tag. More importantly, I wasn’t just paying a fee — I was sacrificing future growth. That $15,000, left untouched and invested at a 7% annual return, could have grown to over $100,000 in 30 years. By withdrawing it now, I wasn’t just covering today’s bills — I was eroding my long-term financial security.

There are limited exceptions to the early withdrawal penalty, such as using funds for qualified medical expenses, first-time home purchases, or higher education. But unemployment is not one of them. Some people turn to 72(t) distributions, also known as Substantially Equal Periodic Payments (SEPP), which allow penalty-free withdrawals if taken in fixed amounts over at least five years or until age 59½, whichever is longer. While this option exists, it requires strict adherence — any modification can trigger retroactive penalties. Another alternative is borrowing from a 401(k), if your former employer’s plan allows it. Loans must be repaid with interest, but the payments go back into your own account, and there’s no tax penalty if managed properly. Still, if you don’t repay on time, the loan is treated as a distribution, subject to taxes and penalties. The bottom line is that retirement accounts are designed for retirement, not emergency funds. Withdrawing early should be a last resort, not a first response. Exploring other options — like payment plans, community assistance, or side income — is almost always wiser.

Missing Out on Valuable Tax Credits

During my period of unemployment, I assumed I wouldn’t qualify for any major tax credits. No job meant no income, which I thought disqualified me from programs like the Earned Income Tax Credit (EITC). But I was wrong. The EITC isn’t limited to full-time workers — it’s available to low-to-moderate-income individuals, including those with partial-year employment or self-employment income. In fact, because the credit is refundable, you can receive it even if you owe no taxes. For someone supporting children, the credit can be substantial — up to several thousand dollars. I had two dependents and had worked for part of the year, which made me eligible. Yet I almost missed it because I filed too early, before receiving all necessary forms, and didn’t know to check for it.

Another credit I overlooked was the Recovery Rebate Credit, which helped taxpayers who didn’t receive the full amount of their Economic Impact Payments during the pandemic. Even if you were unemployed, you might have been entitled to stimulus money that never arrived. This credit allowed you to claim the missing amount on your tax return. Many people dismissed it as irrelevant if they weren’t working, but eligibility was based on prior-year income or household status, not current employment. By not claiming it, I would have left hundreds of dollars uncollected — money the government owed me, but only if I asked for it.

The broader issue here is awareness. Tax credits are not automatically applied; you must qualify and claim them. The IRS doesn’t send reminders or notifications if you’re eligible but fail to file. This places the burden entirely on the taxpayer, which is especially unfair during times of financial distress. Programs like the Child Tax Credit and the American Opportunity Credit for education expenses also have specific rules that can be confusing. For instance, the Child Tax Credit phases out at certain income levels, but if your income dropped due to job loss, you might suddenly qualify again. The key is to review your eligibility each year, even — or especially — when your financial situation changes. A tax professional or free tax preparation service can help identify credits you might miss on your own. In my case, claiming these credits turned a potential tax bill into a modest refund, which I used to rebuild my emergency fund. It was a small win, but one that underscored the value of staying informed.

Health Insurance and the ACA: Tax Implications You Can’t Ignore

Losing my job meant losing employer-sponsored health insurance. I had to enroll in a plan through the Health Insurance Marketplace, which came with its own set of financial and tax considerations. The good news was that I qualified for premium tax credits, which significantly reduced my monthly payments. These subsidies are based on your estimated annual income, so accuracy is critical. I made the mistake of overestimating my income, thinking I’d find a job quickly. Because the subsidy is calculated on what you expect to earn, not what you actually earn, I received more assistance than I should have. When I filed my taxes, I had to repay a portion of those excess credits — a process known as the subsidy reconciliation.

This created a difficult situation. The money I saved on premiums during the year was now owed to the IRS. While there are repayment caps based on income level, they don’t eliminate the burden entirely. Someone at 200% of the federal poverty level, for example, might cap out at a few hundred dollars, but that’s still a significant amount for someone living paycheck to paycheck — or benefit to benefit. The lesson here is to update your income estimate with the Marketplace as soon as your circumstances change. If you lose your job, report it immediately. This allows for a special enrollment period and adjusts your subsidy in real time, reducing the risk of a year-end surprise.

Additionally, medical expenses themselves can affect your taxes. While most people can’t deduct medical costs unless they exceed 7.5% of adjusted gross income, those with high out-of-pocket expenses may benefit from itemizing. COBRA continuation coverage, though expensive, is paid with after-tax dollars, meaning it doesn’t reduce your taxable income. However, any health savings account (HSA) contributions you make are tax-deductible and can be used for qualified medical expenses tax-free. If you had an HSA through your former employer, you can still use the funds, but you can’t contribute unless you’re enrolled in a high-deductible health plan. Navigating these rules requires attention, but the payoff is real: lower premiums, reduced tax liability, and better financial protection during a vulnerable time.

Side Gigs and the Self-Employment Tax Surprise

To make ends meet, I started freelancing — writing, editing, and doing virtual assistant work. It wasn’t much, but it helped. What I didn’t anticipate was the tax burden that came with self-employment. Unlike a traditional job, where taxes are withheld automatically, independent contractors are responsible for paying both income tax and self-employment tax, which covers Social Security and Medicare. The self-employment tax rate is 15.3% — effectively doubling the payroll tax burden compared to a W-2 employee, who only pays half, with the employer covering the rest.

This meant that every dollar I earned from freelancing was taxed more heavily than it would have been as a salaried worker. I also had to make quarterly estimated tax payments to the IRS — April 15, June 15, September 15, and January 15. Missing a deadline results in penalties and interest, which I discovered the hard way after forgetting the second payment. The IRS doesn’t forgive mistakes just because you’re struggling. Keeping track of income and expenses became essential. I began using a simple spreadsheet to log every invoice, payment, and business-related cost — gas, software subscriptions, home office supplies. These expenses are deductible, but only if properly documented. Without receipts or records, the IRS won’t accept them, and you could face an audit.

The gig economy offers flexibility, but it demands financial discipline. You’re not just selling a service — you’re running a business. That means setting aside 25-30% of your income for taxes, opening a separate bank account for business funds, and staying organized year-round. It also means understanding your filing status. Self-employed income is reported on Schedule C, and your net profit flows into your Form 1040. If you earn more than $400, you must file, regardless of whether you receive a 1099-NEC. The good news is that many home-based business expenses are deductible, including a portion of rent, utilities, and internet — but only the percentage used for work. The key is to be accurate, not aggressive. Overstating deductions is a red flag. The goal isn’t to avoid taxes, but to pay only what you owe — nothing more, nothing less.

Rebuilding Financially: Smarter Tax Moves After the Crisis

Once I secured a new job, I didn’t just go back to my old financial habits. I used the experience as a catalyst for change. One of the first things I did was adjust my W-4 withholding to reflect my updated tax situation. I had been under-withheld during unemployment, so I adjusted my allowances to ensure more tax was taken out each pay period, avoiding another large bill next filing season. I also opened a Roth IRA, contributing the maximum allowed. While Roth contributions aren’t tax-deductible, they grow tax-free and can be withdrawn penalty-free in retirement. Given that my income was low during unemployment, it was an ideal time to convert part of my traditional IRA to a Roth — a move known as a Roth conversion. Since I was in a lower tax bracket, I paid less in taxes on the conversion, locking in future tax-free growth.

I also became more strategic about timing. I delayed freelance income into the next tax year when possible and accelerated deductible expenses, like charitable contributions or medical bills, to reduce my taxable income. I reviewed my eligibility for education credits, as I was considering going back to school. I learned about income thresholds — certain benefits phase out at specific levels, so earning just $1,000 too much could cost hundreds in lost credits. By planning around these cliffs, I could optimize my income without triggering penalties.

Most importantly, I built a system. I set up automatic transfers to a dedicated tax savings account, treating taxes as a non-negotiable expense. I scheduled reminders for estimated payments and kept all financial documents in one digital folder. I also started meeting with a tax advisor annually, even when my situation seemed simple. These steps didn’t make me rich, but they gave me control. What began as a period of loss became a foundation for long-term resilience. I now see tax planning not as a chore, but as a form of self-protection — especially during uncertain times.

Turning Pitfalls into Protection

Unemployment exposed how fragile my financial knowledge really was — especially around taxes. But by facing those gaps head-on, I built a more informed, cautious, and ultimately stronger financial foundation. These lessons aren’t just about surviving a crisis — they’re about emerging smarter. The pitfalls I encountered — taxable unemployment benefits, early withdrawal penalties, missed credits, subsidy repayments, self-employment tax — are not unique to me. They’re systemic challenges that millions face every year. What sets people apart is whether they learn from the experience or repeat the same mistakes. Tax planning during unemployment isn’t optional; it’s essential. It’s not just about compliance, but about preserving stability when everything else feels unstable. By treating every dollar with intention, understanding the rules, and seeking help when needed, you can turn a painful chapter into lasting financial strength. The goal isn’t perfection — it’s progress. And sometimes, the hardest lessons lead to the most valuable gains.