How I Smartly Allocate Assets While Staying Tax-Safe

You’re not alone if you’ve ever felt confused about how to grow your money without tripping over tax pitfalls. I’ve been there—shifting investments, overcomplicating strategies, and nearly overpaying taxes. What changed? A smarter approach to asset allocation that works with the tax system, not against it. In this article, I’ll walk you through a practical, compliant strategy that balances growth, risk control, and tax efficiency—all without jargon or guesswork. This is not about aggressive tax avoidance or chasing high-risk returns. It’s about making informed, sustainable choices that respect both financial goals and legal responsibilities. The foundation of lasting wealth isn’t just picking the right investments—it’s placing them in the right accounts, at the right time, with full awareness of how taxes interact with every move.

The Hidden Tax Trap in Your Portfolio

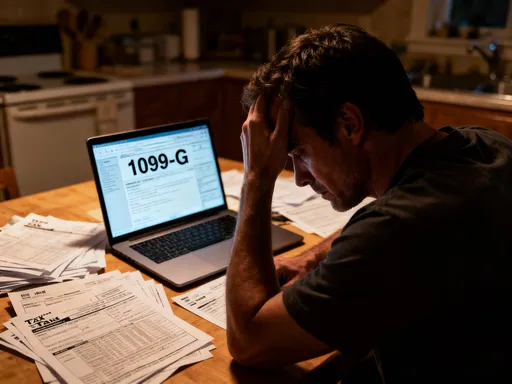

Many investors measure success solely by returns, yet overlook a silent drain on their wealth: taxes. It’s not uncommon for individuals to celebrate a 7% annual return, only to realize that after capital gains, dividend taxes, and unnecessary withdrawals, their actual net gain is closer to 4%. The difference? Poor tax-aware asset allocation. When high-turnover investments like actively managed mutual funds or frequent stock trades are held in taxable brokerage accounts, every gain triggers a potential tax event. Even reinvested dividends are taxable in these accounts, compounding the burden over time. This mismatch between asset type and account structure turns compounding into a double-edged sword—while investments grow, so does the tax liability.

Consider a real-life scenario: a mid-career professional who consistently invested in a taxable account, favoring dividend-paying stocks and bond funds for stability. Over five years, the portfolio grew by $120,000. However, annual dividend distributions totaling $18,000 were taxed each year at ordinary income rates, and two fund sales triggered $25,000 in short-term capital gains—taxed at 24%. The result? Over $10,000 in taxes paid during accumulation, not at retirement. This wasn’t due to poor investment choices, but to a lack of strategic placement. Had those same assets been structured with tax efficiency in mind—dividend stocks in tax-free accounts, bonds in tax-deferred—thousands could have been preserved. The takeaway is clear: unstructured allocation doesn’t just risk volatility—it risks overpayment.

Tax inefficiency often stems from emotional or reactive decisions. Market dips prompt panic selling, locking in losses without considering tax-loss harvesting opportunities. Bull markets tempt investors to chase performance, leading to frequent trading in taxable spaces. Each transaction has consequences. Long-term capital gains, taxed at lower rates, are only beneficial if assets are held long enough. Short-term trades, even when profitable, are taxed as ordinary income, eroding returns. The hidden trap is not the tax code itself, but the failure to plan within its framework. Recognizing this is the first step toward building a portfolio that grows not just in value, but in after-tax value.

Asset Allocation That Respects Tax Rules

True financial progress comes not only from selecting strong investments, but from placing them in the right environments. This concept is known as tax-aware asset location—a deliberate strategy of matching investment types to account types based on their tax characteristics. Not all accounts are created equal. Taxable brokerage accounts offer flexibility but expose earnings to annual taxation. Traditional IRAs and 401(k)s provide tax deferral, meaning contributions may be tax-deductible and growth accumulates untaxed until withdrawal. Roth IRAs, funded with after-tax dollars, allow tax-free growth and tax-free withdrawals in retirement. Understanding these differences allows investors to maximize efficiency.

Equities with high dividend yields, such as utility or consumer staples stocks, are better suited for Roth IRAs. Why? Because dividends in taxable accounts are subject to taxation each year, even if reinvested. In a Roth IRA, those same dividends grow and can be withdrawn tax-free, assuming rules are followed. Similarly, bonds—especially taxable corporate bonds—generate regular interest income taxed as ordinary income. Holding them in a traditional IRA defers this tax burden until retirement, when the investor may be in a lower tax bracket. This deferral allows compounding to occur on a larger base, enhancing long-term growth.

Growth-oriented stocks, particularly those held for the long term, often perform best in taxable accounts. Why? Because when sold after one year, gains qualify for long-term capital gains rates, which are typically lower than ordinary income rates. Additionally, investors can control the timing of these gains by deciding when to sell. This flexibility is lost in retirement accounts, where withdrawals are taxed as ordinary income regardless of the underlying asset’s behavior. Municipal bonds, which generate interest exempt from federal taxes and sometimes state taxes, are ideal for taxable accounts, especially for those in higher tax brackets. By aligning each asset class with its optimal account type, investors don’t just reduce taxes—they enhance the efficiency of compounding.

This strategy is not about gaming the system. It’s about working within it wisely. The IRS does not penalize thoughtful planning; it rewards compliance through the structures it provides. Tax-advantaged accounts exist to encourage long-term saving, not to create complexity. When investors treat these accounts as tools rather than afterthoughts, they unlock significant advantages. The key is intentionality—each investment decision should include a second question: “Where should I hold this?” Answering that correctly can save tens of thousands over a lifetime.

Building a Risk-Aware, Tax-Efficient Structure

A resilient financial plan does more than seek returns—it manages risk and minimizes surprises, including tax-related ones. Diversification is often discussed in terms of asset classes, but it’s equally important across account types. A portfolio spread across taxable, tax-deferred, and tax-free accounts provides not only financial flexibility but tax flexibility. During market downturns, for example, an investor with multiple account types can choose where to draw funds from, potentially avoiding forced sales in taxable accounts that would trigger capital gains. This strategic control reduces the likelihood of incurring unnecessary tax liabilities during volatile periods.

Rebalancing is another area where tax awareness is crucial. Over time, market movements can shift a portfolio’s original allocation, necessitating adjustments. Doing so carelessly—by selling appreciated assets in a taxable account—can create an immediate tax bill. A smarter approach involves using new contributions to buy underweight assets in taxable accounts, or selling overweights within tax-advantaged accounts where no tax is triggered. In-kind transfers, where assets are moved between accounts without selling, can also preserve tax status while restoring balance. These methods maintain strategic alignment without incurring avoidable costs.

Tax-loss harvesting is a powerful tool within this framework. When an investment declines in value, selling it locks in a loss that can offset capital gains elsewhere in the portfolio. If losses exceed gains, up to $3,000 can be used to reduce ordinary income annually, with additional losses carried forward. This isn’t about profiting from market drops, but about turning setbacks into tax relief. For example, an investor with $10,000 in realized gains can eliminate the tax burden by harvesting $10,000 in losses. This strategy requires discipline—wash sale rules prohibit repurchasing the same or substantially identical security within 30 days—but when applied correctly, it enhances net returns without increasing risk.

The goal is to build a structure that adapts to changing markets and life stages without triggering avoidable taxes. As investors approach retirement, for instance, the focus may shift from growth to income. A tax-efficient structure allows for strategic withdrawals—pulling from traditional IRAs to fill lower tax brackets, using Roth funds for flexibility, and managing taxable account sales to stay within favorable capital gains thresholds. This level of control doesn’t happen by accident. It results from deliberate design, grounded in both financial and tax planning principles.

Real Moves That Save Real Money

Understanding theory is valuable, but implementation delivers results. Consider a household with a $500,000 portfolio split evenly between a taxable brokerage account and a traditional IRA. Historically, they held bond funds in the taxable account for stability and growth stocks in the IRA. A review revealed that the bond fund’s 3% annual yield generated $7,500 in taxable interest each year, taxed at their 22% marginal rate—costing $1,650 annually. By shifting the bond allocation to the traditional IRA and moving a growth stock fund to the taxable account, the tax burden on interest disappeared, and future stock gains could qualify for lower long-term capital gains rates. This simple swap saved over $1,600 per year, compounding to more than $25,000 in savings over a decade, assuming reinvestment and modest growth.

Another practical step is incorporating municipal bonds into taxable accounts. For investors in higher tax brackets, the tax-equivalent yield of munis often surpasses that of taxable bonds. A municipal bond yielding 3% is equivalent to a taxable bond yielding 4.41% for someone in the 31% tax bracket—because the muni’s interest is federally tax-free. This isn’t a speculative play; it’s a recognized, legal advantage available to all. Similarly, maximizing contributions to retirement accounts—especially when employer matches are involved—delivers immediate tax benefits and long-term compounding. A $6,000 annual Roth IRA contribution, growing at 6% over 25 years, becomes over $350,000—all tax-free in retirement.

Tax-efficient fund placement extends to mutual funds and ETFs. Index funds and buy-and-hold ETFs tend to be more tax-efficient than actively managed funds due to lower turnover. Holding these in taxable accounts minimizes capital gains distributions. Conversely, actively managed funds, which may generate frequent taxable distributions, are better placed in tax-deferred accounts. Even within retirement accounts, choices matter. Holding real estate investment trusts (REITs) in a traditional IRA avoids the high dividend tax rates they trigger in taxable accounts. These are not exotic strategies—they are accessible, logical moves that align with how the tax code functions.

The cumulative effect of these decisions is profound. Small adjustments, consistently applied, reshape financial outcomes. One study by financial researchers estimated that tax-aware asset location can add 0.5% to 1.0% annually to after-tax returns. For a $1 million portfolio, that’s $5,000 to $10,000 in additional value each year—without taking on more risk. This isn’t about finding loopholes; it’s about using the system as intended, with patience and precision.

The Cost of Getting It Wrong

Mistakes in asset allocation often compound silently, revealing their cost only at tax time or in retirement. One common error is overtrading within taxable accounts. Frequent buying and selling generate short-term capital gains, taxed at higher rates. An investor who turns over their portfolio multiple times a year may pay 20% to 30% more in taxes than a buy-and-hold counterpart, even with identical returns. The impact is especially severe in rising markets, where gains are substantial but poorly timed sales erode net profits.

Another pitfall involves international funds. While global diversification is sound, some foreign funds distribute income that is taxed at ordinary rates and may be subject to foreign tax withholding. If held in a taxable account, investors must navigate foreign tax credits and complex reporting. Placing such funds in tax-deferred accounts simplifies compliance and delays tax on distributions. Similarly, holding REITs in taxable accounts exposes investors to high ordinary income tax rates on dividends, which can exceed 25%. In a traditional IRA, those distributions grow tax-deferred, preserving more capital for compounding.

Failure to coordinate account types can also lead to inefficient withdrawals. Drawing first from a taxable account with highly appreciated stocks may push an investor into a higher capital gains bracket. Conversely, neglecting required minimum distributions (RMDs) from traditional IRAs can result in penalties of 50% of the missed amount. These are not hypothetical risks—they are real consequences faced by otherwise diligent savers. The cost of getting it wrong isn’t just financial; it’s emotional. Tax season becomes a source of stress rather than a routine obligation.

Yet, the good news is that most of these errors are preventable. Awareness is the first defense. Regular portfolio reviews, ideally before year-end, allow time to correct misalignments. Consulting with a tax-aware financial advisor can provide personalized guidance. The goal isn’t perfection, but progress—moving from reactive to proactive, from costly to calculated.

Tools and Habits for Long-Term Success

Sustaining tax efficiency requires more than a one-time strategy—it demands ongoing habits and the right tools. One of the most effective practices is the annual tax impact review. Before December 31, investors should assess their portfolio for potential gains, losses, and distribution dates. This allows time to harvest losses, delay sales, or adjust contributions to minimize tax exposure. Many brokerage platforms now offer tax cost basis reporting, which tracks purchase prices and holding periods, making it easier to calculate gains and losses accurately.

Automation can support consistency. Setting dividend reinvestments to occur within tax-advantaged accounts prevents unintended taxable events. Enabling tax-loss harvesting features, available at several major platforms, allows for systematic loss capture without constant monitoring. Calendar alerts for RMDs, contribution deadlines, and estimated tax payments help avoid penalties and missed opportunities. These tools don’t replace judgment, but they reinforce discipline.

Another valuable habit is maintaining clear records. Tracking contributions, conversions, and asset transfers ensures compliance and simplifies tax filing. For those with multiple accounts, a consolidated view—either through financial aggregation tools or spreadsheets—provides clarity on overall allocation and tax exposure. This visibility supports better decision-making throughout the year, not just at tax time.

Finally, education is ongoing. Tax laws evolve, and so do investment options. Staying informed through reputable financial publications, IRS resources, or certified financial planners helps investors adapt. The goal is not to become a tax expert, but to be an informed participant in one’s financial life. With the right habits and tools, tax-smart investing becomes a natural part of wealth building, not an occasional chore.

Growing Wealth the Smart Way

At its core, wealth building is not about chasing the highest returns, but about preserving and growing what you earn. A tax-compliant, risk-managed approach to asset allocation ensures that more of your money stays with you, compounding over time without unnecessary erosion. This is not a get-rich-quick scheme, but a get-rich-slow-and-steady method grounded in discipline, awareness, and respect for the rules. The most successful investors aren’t those who pick the best stocks, but those who structure their portfolios to work efficiently within the system.

Patience and structure go hand in hand. A well-allocated portfolio adapts to life changes, market cycles, and tax environments without drastic overhauls. It provides peace of mind, knowing that decisions are based on strategy, not emotion. It reduces tax season anxiety, replacing it with confidence. And it supports long-term goals—whether funding education, buying a home, or retiring with dignity—by maximizing after-tax wealth.

The journey to financial strength begins with a single realization: growth and compliance are not opposites. They are partners. By aligning asset allocation with tax efficiency, investors gain more control, more predictability, and more sustainability. This is how wealth grows—not through shortcuts, but through smart, legal, and consistent choices. In the end, the greatest return isn’t just in dollars, but in the security and freedom that come from knowing your money is working as hard as you do.